The Effects of Negatively Priced Oil!

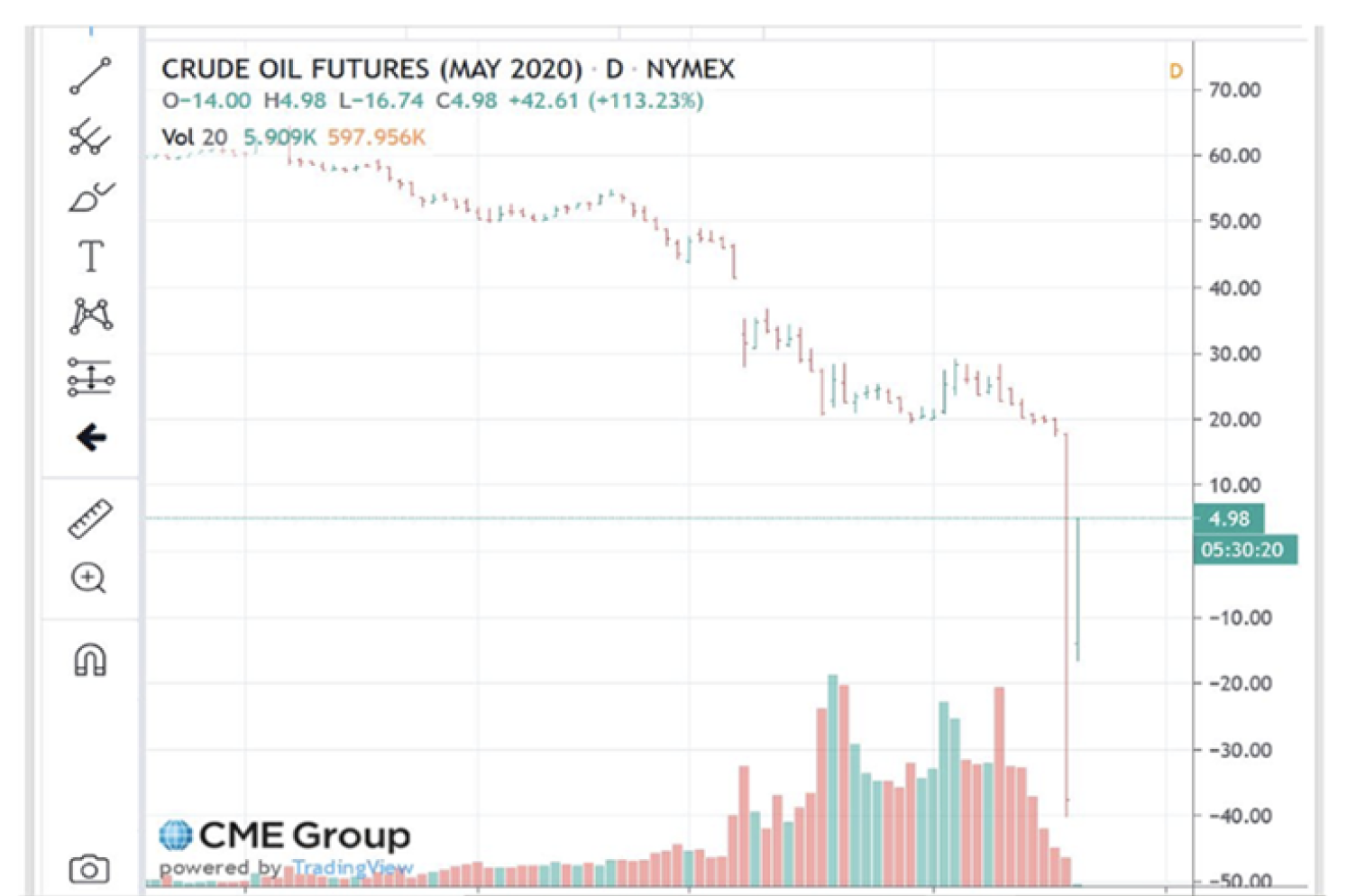

With global economies dealing with COVID-19, imposing lockdowns to curb its spread and triggering what some have deemed a "self-inflicted economic suppression", the delicate balance between oil supply and demand in early January has now turned into a swelling glut. This week, the oil oversupply turned oil prices negative for the first time in history, with West Texas Intermediate (WTI) trading as low as (-$37.00) a barrel.

What's Going on With Oil?

In light of this seemingly impossible occurrence, many are rightly asking how and why negative oil prices could be possible? To answer this, one must understand the unique issues facing oil markets right now: falling demand, excess supply, and limited storage. First, a primer on how the oil markets function.

A futures contract is a standardized legal agreement to buy or sell something at a predetermined price at a specified time in the future, between parties not known to each other. The fact that futures contracts are standardized and exchange-traded makes these instruments indispensable to commodity producers, consumers, traders, and investors.

The WTI futures contract is standardized for 100,000 barrels of oil. If you purchase an oil futures contract and do not sell it before its expiration, you will have 100,000 barrels delivered to you. Other words, the oil future contract is "physically delivered".

Last week was rather unusual as owners of these oil futures contracts wanted to exit their long positions before they expired. Instead of taking delivery, selling at a much lower price allowed them to exit the long position. This extraordinary demand to sell caused the massive spike down into negative prices.

WTI May 2020 Futures Chart

Prices Stuck in the Oil Patch: Falling Demand, Sticky Supply, and Limited Storage

Falling demand: While oil demand was already under pressure due to slowing Chinese growth, the sudden global economic shock caused by COVID-19 has seen oil demand collapse. The International Energy Agency (IEA) predicts that global oil demand will fall by a record 9.3 million barrels per day (mb/d) in 2020 versus last year. Much of this demand destruction will occur in the next two months, with demand falling by 20 mb/d in April and May.

Bottom line: The world economy consumes more than 90 mb/d of crude, but since the COVID-19 outbreak consumption has dropped by more than 25 mb/d. That is unprecedented!

Originally, consensus accounted for a demand destruction of 4.0 mb/d over March and April. As the virus' spread seems to have scaled up dramatically consensus significantly reduced expectation for oil demand. First, the impact is likely be larger than previously anticipated, and will likely see strong contractions in Asia and Europe along with factoring in the impact on the US economy.

Excess supply: This week, the excess supply problem bubbled to the surface, with expiring WTI futures contracts pressing crude buyers to find storage. But with storage facilities mostly full, storage costs have skyrocketed, pushing crude prices deep into negative territory. This was a highly unusual situation, with much-reduced production still outpacing collapsing demand.

After an initial disagreement in March, major oil producers agreed to cut production by a record 9.7 million barrels per day, beginning May 1, with further cuts expected in the next 12 months. However, that did not help matters this week as it takes much time to implement production cuts and compliance amongst countries is never guaranteed.

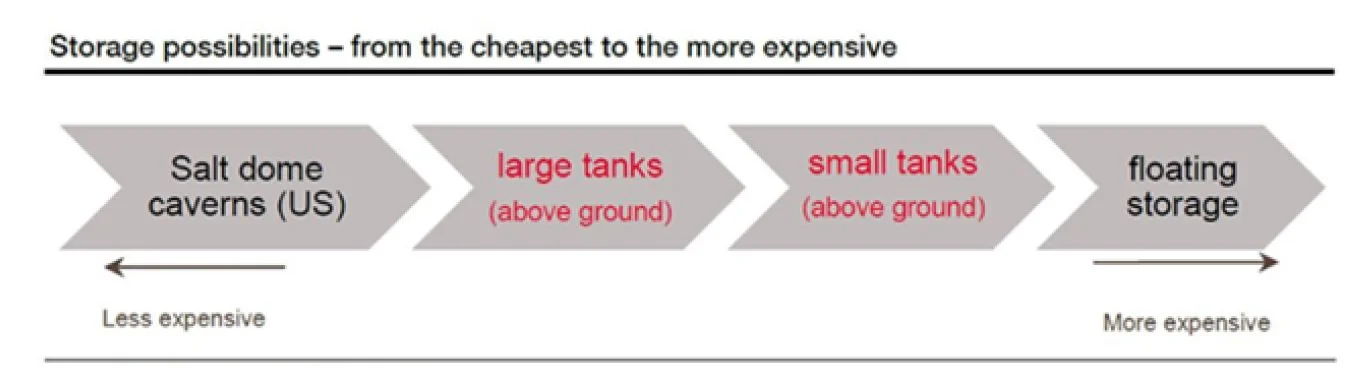

Limited Storage: Imbalances between oil demand and supply are common. Normally, any excess supply of oil would be placed into storage facilities and the owner would wait for favorable prices. However, oil storage facilities are already over 70% full - up from 40% at the start of the year. Storage facilities are forecasted to be completely full by mid-2020 based on current production levels.

Source: SG Cross Asset Research/Commodity Strategy

With current supply and demand imbalances, energy experts expect global on-land storage across the globe to reach full capacity around June-July. This will increase storage costs as supply will be channeled towards more expensive storage capacity such as small on-land tanks, railcar storage and floating storage.

Additionally, while some capacity remains in above ground storage, the price has tripled from these "normal" levels and the spare capacity has been fixed and is therefore unavailable.

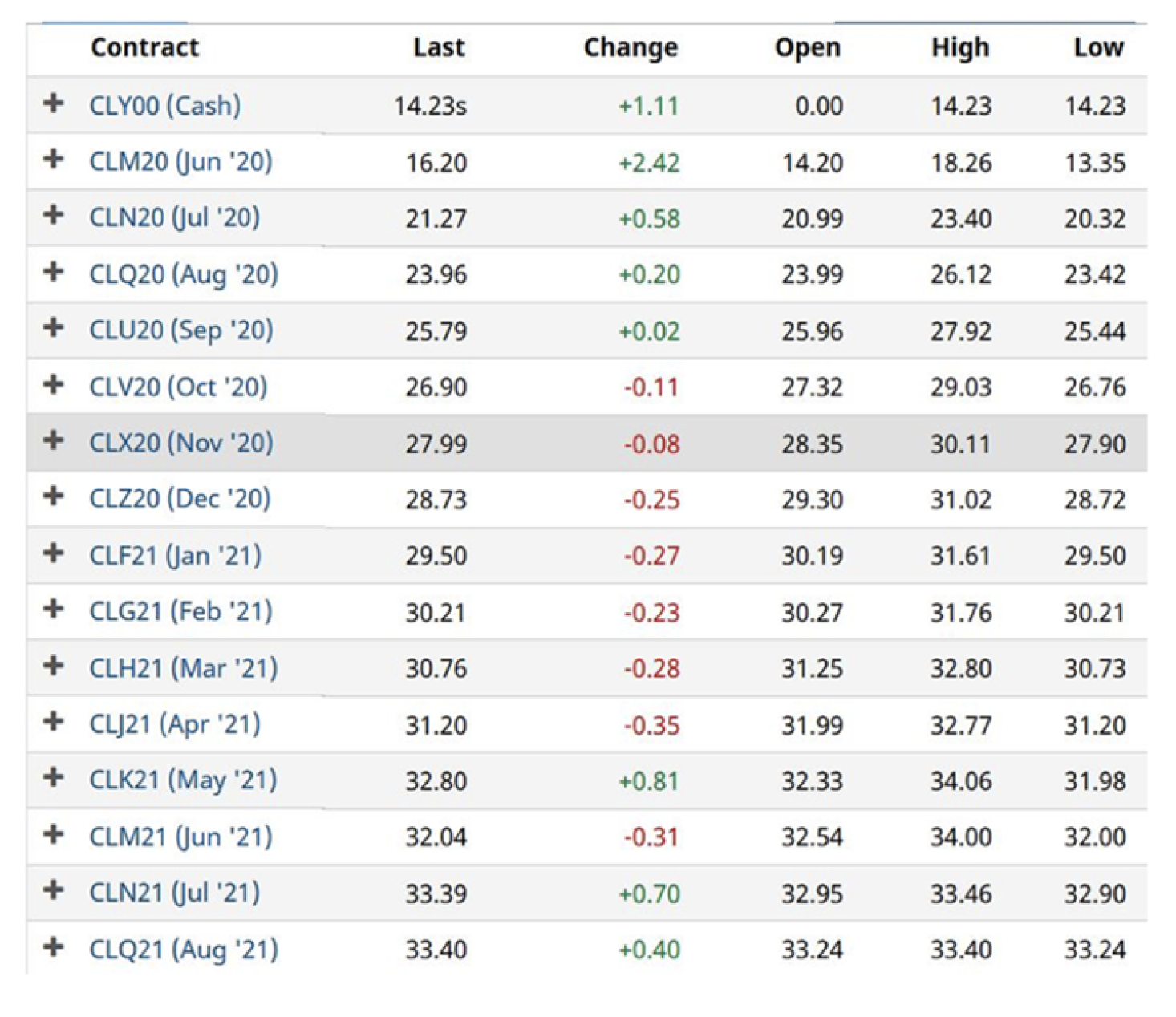

Tango with Contango: WTI futures prices suggest an oil recovery?

The chart below should offer a glimmer of hope. The WTI futures market is in what commodity traders call a "super contango" whereas the spot price (cash price for immediate delivery) for a commodity is trading dramatically below the futures price. Notice that the current cash price for WTI is $14.23 per barrel. However, if you wish to purchase WTI for November 2020 delivery, you will pay $27.99. And, if you would prefer to wait until May 2021, you will cost you $32.80. As a result, it seems likely that the pressure of negative oil prices will not be in place forever!

CMEGROUP WTI futures prices

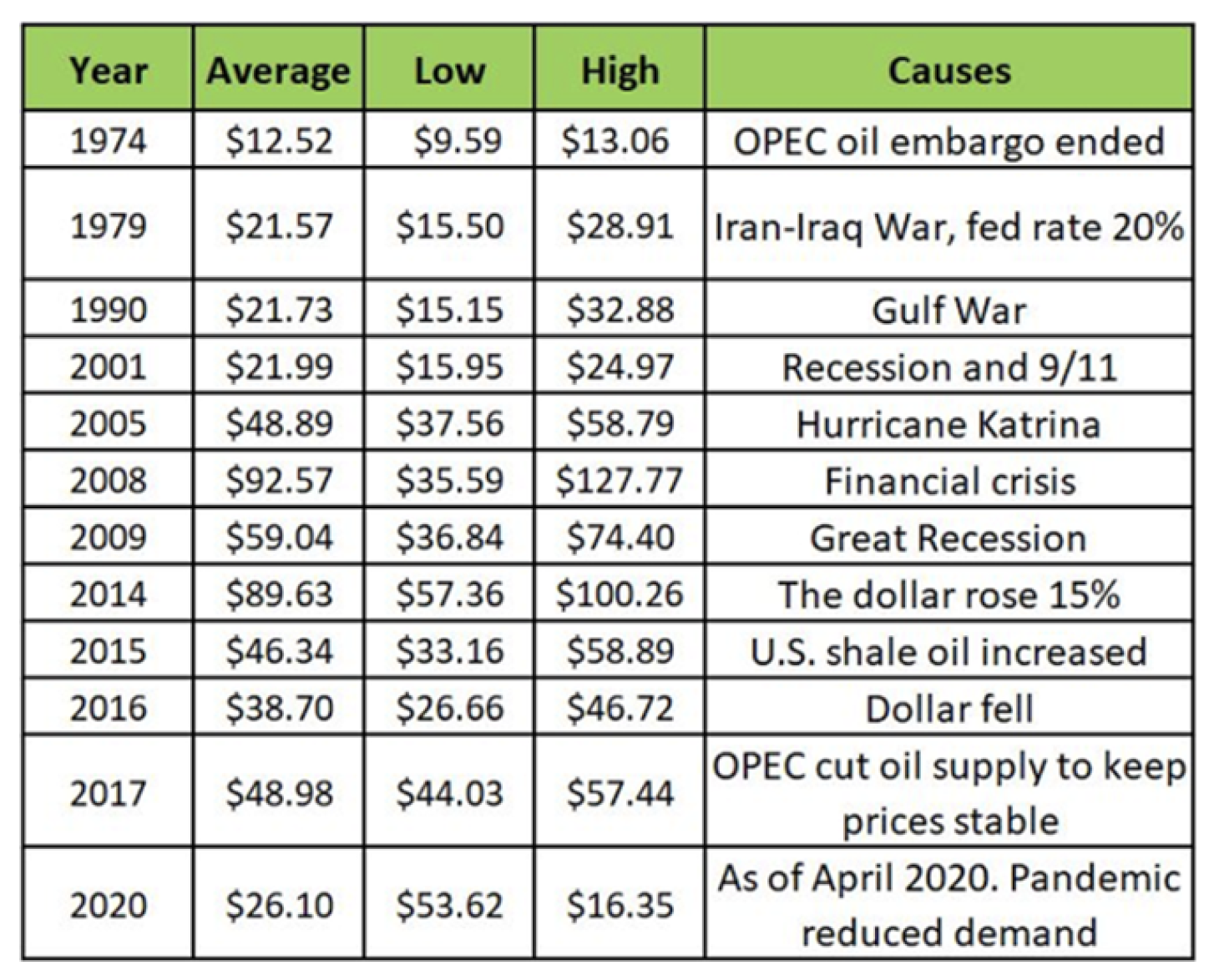

Nothing New Under the Sun

Since the mid-1970's there have been a half-dozen oil shocks somewhat similar in enormity to what we've witnessed last week. According to recent history, when decreases were the result of increased production, the economy generally behaved well. When declines coincided with apathetic growth prospects, the economy usually suffered. There is no doubt there are portions of both demand and supply this time around but - presently it appears we are skewed towards over supply rather than lack of demand. At some point the market will come to terms with the reality that this is yet another cycle - one that the markets will eventually digest.