Investor Minute Series

The savings-draining scam few victims want to talk about

Gloria (not her real name) was furious with her financial advisor. She wanted to move some money out of one of her accounts and her advisor, Melissa, told her she was hesitant to help with the transaction.

How dare her advisor intrude into this part of Gloria’s life? How dare she ruin what might be Gloria’s last chance for a happy relationship after her divorce?

But Melissa stuck to her guns. Something about the transaction didn’t seem right. With her fiduciary duty, she had a responsibility to act in her client’s best interest—even if it was making her upset.

This was the transaction Gloria was asking for: Take nearly $50,000 out of her retirement account and transfer it to the European bank account of a man named Thomas. A man Gloria had never met. And in fact, someone she had never even spoken to by phone.

By enlisting the help of a banking official and eventually the police, Melissa was able to poke major holes in the identity and story that “Thomas” had been using. Gloria agreed not to send the money.

Even so, she felt deeply conflicted. And she sent “Thomas” a note apologizing for letting him down.

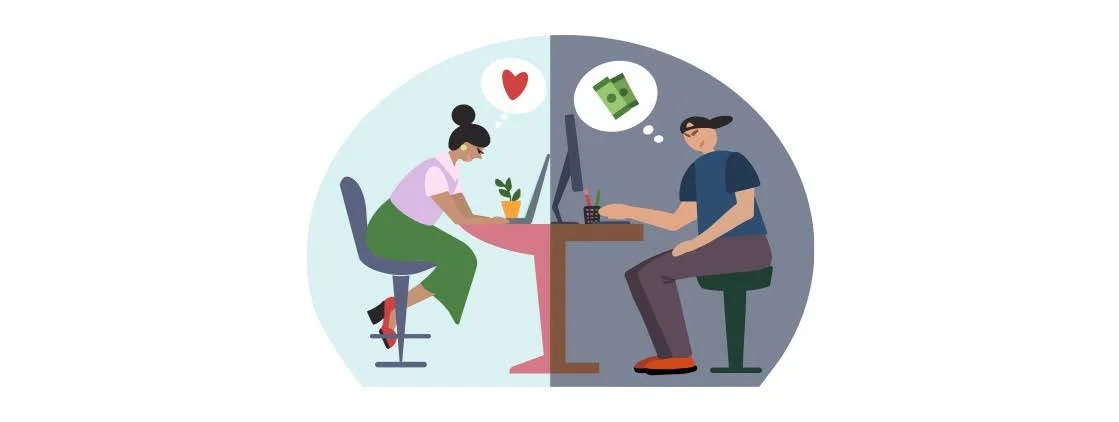

Gloria was the victim of a romance scam.

She had met “Thomas” through an online dating site, where he claimed to have a job at a Fortune 500 company that required travel to Europe. Soon they were exchanging emails and text messages directly. Yet he was careful to move slowly. Over several months their interactions went from friendly to flirtatious to fully romantic.

It was not until then that he first asked for money. He said he was on a business trip and there had been a problem with his credit card. Could she loan him a few thousand dollars to get him out of this jam? Gloria was happy to help.

The next time he asked for more. Again, it seemed legitimate. And again, Gloria complied.

It was the classic con artist’s ploy of starting small to gain the victim’s trust.

Then he went big, asking Gloria to loan him $47,772 to get a shipment out of customs. The specific amount and an official-looking form he faxed were all the convincing she needed. And Gloria would have sent the money; however, her advisory firm had a rule about speaking directly with clients for large withdrawals.

According to the Federal Trade Commission, Americans lost more than $200 million to romance scams in 2019 (the latest year for which data is available). But experts estimate the loss to be much higher since victims of this kind of theft are reluctant to come forward.

It seems unthinkably cruel to lead someone on for months for the purpose of stealing their life savings. And that may be why intelligent and otherwise savvy people fall victim to this kind of scam.

For you and your loved ones, be wary of anyone seeking an online relationship who won’t talk in person, who insists on keeping the relationship a secret, and who can’t provide personal details that can be verified.

Sources:

1.https://www.wealthmanagement.com/client-relations/love-hurts-financial-advisor-breaks-romance-scam

Disclosure:

The views expressed herein are exclusively those of Efficient Advisors, LLC (‘EA’), and are not meant as investment advice and are subject to change. All charts and graphs are presented for informational and analytical purposes only. No chart or graph is intended to be used as a guide to investing. EA portfolios may contain specific securities that have been mentioned herein. EA makes no claim as to the suitability of these securities. Past performance is not a guarantee of future performance. Information contained herein is derived from sources we believe to be reliable, however, we do not represent that this information is complete or accurate and it should not be relied upon as such. All opinions expressed herein are subject to change without notice. This information is prepared for general information only. It does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. You should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. You should note that security values may fluctuate and that each security’s price or value may rise or fall. Accordingly, investors may receive back less than originally invested. Investing in any security involves certain systematic risks including, but not limited to, market risk, interest-rate risk, inflation risk, and event risk. These risks are in addition to any unsystematic risks associated with particular investment styles or strategies.